How to Make a Financial Plan

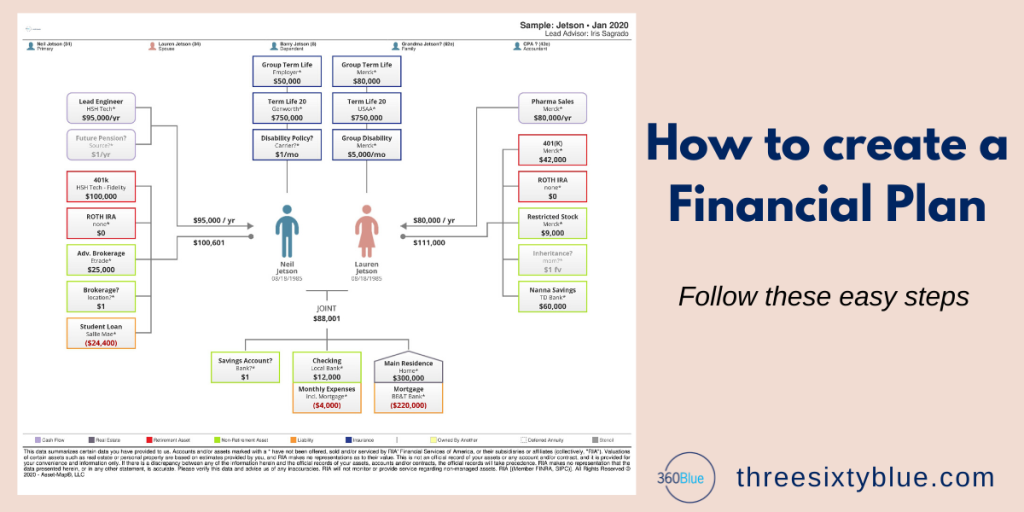

Creating a financial plan is an excellent way to start saving for your future. It will help you save for different types of expenses, such as vacations or down payments. You can either create a plan yourself or hire a financial planner to do it for you. The first step in making your financial plan is to create a financial snapshot of your current situation.

Your plan should include your income and expenses now. It should also include any debts you may have. Knowing which debts are most important to pay off first will help you determine where to allocate your money. You can also use your financial plan to evaluate your spending habits each month and make adjustments as necessary to save more money and reduce debt. A financial plan should be tailored to your unique situation, as well as your goals and risk tolerance.

Once you’ve made a plan, review it once a year or more frequently, especially if major life events take place. You can even update it when you achieve a significant milestone. Creating a financial plan is easier than you might think. By taking the time to review your plan, you’ll have a bulletproof strategy for your future.

Your plan should also include a long-term goal. A good example is retirement. It’s best to start saving for retirement when you’re still young, so you’ll have more time to contribute to the fund. Ideally, you should save up ten to fifteen percent of your post-tax income to your retirement account.

You should also make sure that you update your financial plan every year, as unexpected life events can change your financial situation. The time you dedicate to making a financial plan will help you avoid making costly mistakes that may prevent you from reaching your financial goals. You can also make changes to your plan if you discover you’ve hit a roadblock along the way.

Having a financial plan can give you confidence in your spending habits. It can also help you avoid worrying about bills and unexpected expenses. It will also help you achieve your goals. Financial planning can alleviate your stress about your finances and help you feel confident about your future. A financial plan template will help you build a strategy and track your progress.

The first step in making a financial plan is to identify your financial goals. Then, identify concrete steps to achieve them. You should rank the goals from most important to least important. Make sure that you choose long-term goals and not short-term goals. Another step in creating a financial plan is to create a budget.

Once you have a financial plan, you can begin to build wealth. This can be done by saving and investing. Depending on your goals, you can make different plans for short-term and long-term goals. The short-term plan can focus on building your wealth now, while the long-term plan will focus on retirement. You should also consider your lifestyle and health, as these factors contribute to wealth.