What Is a Financial Advisor?

What Is a Financial Advisor?

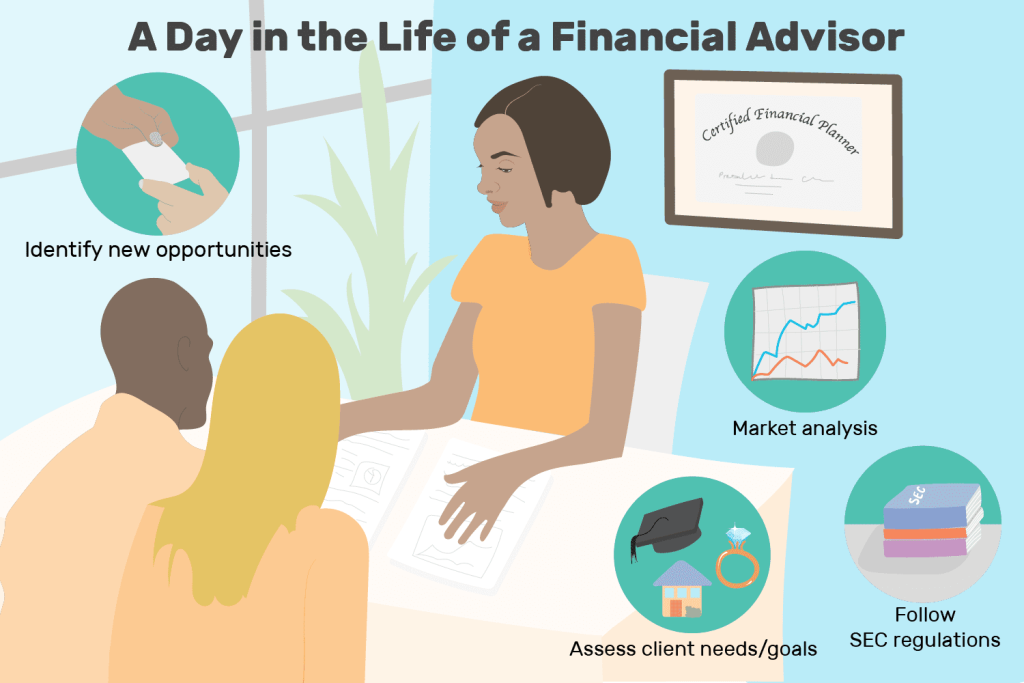

A financial advisor is an individual who helps people plan their financial future. This person can help clients increase their retirement savings, identify shortfalls, and protect their assets. The advisor can also help people create charitable gifts and make legacy wishes. An advisor can also help clients plan for long-term care and healthcare.

A financial advisor can help clients sort out their assets so they make the best use of their cash flow. They can also advise clients on which assets to invest in, which will help them increase their wealth. A financial advisor can also provide an outside perspective on corporate development projects and help clients determine the viability of the venture.

Financial advisors can help clients achieve their financial goals and achieve financial independence. They can be self-employed or part of a larger firm. Many advisors seek professional designations. Their salary varies, but is generally above average for the profession. There are many factors to consider when determining the right financial advisor for you.

A financial advisor may not be right for you if you’re inexperienced in managing your finances. They might be better suited to help people with more complex financial situations. Some financial advisors specialize in different types of services. For example, some specialize in credit or large investments. In this case, they will be better suited to your specific needs.

Financial advisors must adhere to a code of ethics. In addition, they must be able to put the needs of their clients first. They must also develop relationships with their clients and seek out new clients. They should be social media-savvy and have a professional website. Financial advisors may also give presentations to groups of people or present customized financial plans. A financial advisor must be an excellent communicator.

If you are looking for a financial advisor, it’s important to shop around to find the right one for your needs. Look at their business model, and note whether or not they charge commissions or fee-only. If you’re looking for an advisor who is 100% dedicated to your financial future, you should consider working with a fiduciary. A fiduciary is a professional who puts their client’s interests above their own.

There are many different types of financial advisors, and each one offers a unique range of financial services. An independent advisor can offer you a more diverse range of products and operate more objectively, so he or she may be able to meet your needs better. Financial advisors provide many different services, so the best choice for you is to ask yourself what you need.

A financial advisor may also help you with tax planning. For example, an advisor may be able to help you with charitable donations, or help you take advantage of tax-loss harvesting. You can compare financial advisors by reading customer reviews and assessing their track record and qualifications.